At Taxfyle, we join individuals and small companies with licensed, experienced CPAs or EAs in the US. We deal with the exhausting part of finding the right tax skilled by matching you with a Pro who has the right expertise to fulfill your unique wants and can deal with filing taxes for you. Right Here are a few of the mostly asked questions about accrued depreciation. Get immediate entry to video classes taught by experienced funding bankers.

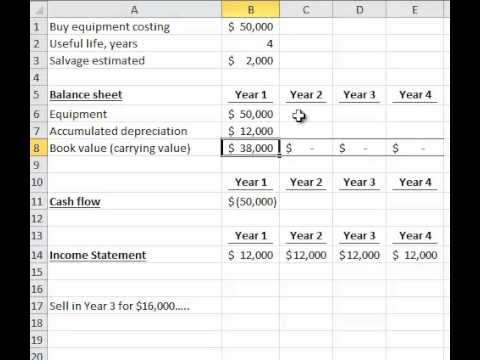

If the equipment continues for use, no additional depreciation expense might be reported. The account balances remain within the general ledger till the equipment is offered, scrapped, and so forth. Depreciation is an accounting entry that reflects the gradual reduction of an asset’s price over its helpful life. Accumulated depreciation is the quantity of whole depreciation expense that has been charged on the asset because the https://www.simple-accounting.org/ date of its recognition.

- Accrued depreciation is an important accounting idea that represents a set asset’s whole depreciation over its useful life.

- The belongings to be depreciated are initially recorded in the accounting data at their value.

- You ought to think about our supplies to be an introduction to chose accounting and bookkeeping matters (with complexities probably omitted).

- Leo’s Trucking Company purchases a brand new truck for $10,000 on the first of the yr.

Accountants often say that the aim of depreciation is to match the price of the truck with the revenues that are being earned by utilizing the truck. Others say that the truck’s price is being matched to the durations during which the truck is getting used up. Without depreciation, a company must bear the whole cost of an asset within the 12 months of buy, which could have a adverse impact on profitability. For instance, a retail chain with $500,000 in accrued depreciation for its retailer tools exhibits the equipment’s remaining value at $200,000, offering insight into its financial health. For instance, a publishing company data amassed depreciation for its printing tools and amortization for its copyrights. For example, a producing firm with equipment bought for $100,000 and $60,000 in amassed depreciation exhibits a net guide value of $40,000.

The double-declining-balance (DDB) method, which can additionally be known as the 200%-declining-balance methodology, is considered one of the accelerated methods of depreciation. DDB is an accelerated methodology because more depreciation expense is reported in the early years of an asset’s life and less depreciation expense within the later years. The asset’s price minus its estimated salvage value is identified as the asset’s depreciable price.

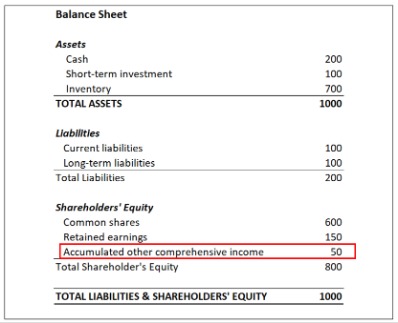

Amassed depreciation is the whole quantity of depreciation expense recorded for a hard and fast asset over its helpful life. A lot of individuals confuse depreciation expense with actually expensing an asset. Fixed belongings are capitalized when they’re bought and reported on the steadiness sheet. You ought to note that the expense recorded each time is added to the amassed depreciation account.

Amassed Depreciation: Full Information For Investors

An expense reported on the earnings statement that did not require the usage of cash in the course of the period proven in the heading of the income statement. Additionally, the write-down of an asset’s carrying quantity will lead to a noncash charge in opposition to earnings. To introduce the concept of the units-of-activity methodology, let’s assume that a service business purchases distinctive tools at a cost of $20,000. Over the equipment’s useful life, the business estimates that the equipment will produce 5,000 useful gadgets. Assuming there is not a salvage worth for the gear, the enterprise will report $4 ($20,000/5,000 items) of depreciation expense for each item produced.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. As Soon As an asset is fully depreciated, its e-book value is equal to its salvage worth. Discover on-line accounting courses that will help you study more about this subject. Many of those programs are self-paced, permitting you to study round your schedule. You might consider the Accounting for Determination Making course supplied on Coursera by the College of Michigan. It could have a guide worth of $100,000 at the finish of its helpful life in 10 years.

Accelerated methods like double declining stability or sum-of-the-years’-digits allow you to claim larger deductions early, decreasing your tax legal responsibility and releasing up cash for reinvestment. The straight-line technique spreads costs evenly, making financial planning easier. Businesses that optimize depreciation can decrease taxable earnings and reinvest financial savings. On your stability sheet, accumulated depreciation seems as a contra-asset account.

Examples Of Assets To Be Depreciated

The ending guide worth of one year turns into the beginning book worth of the subsequent 12 months. That part of the accounting system which contains the stability sheet and earnings statement accounts used for recording transactions. The net of the asset and its related contra asset account is referred to as the asset’s book worth or carrying value. This would come with long term assets similar to buildings and equipment used by an organization.

Suggestions For Enterprise House Owners And Buyers

The “declining-balance” refers again to the asset’s book value or carrying worth (the asset’s cost minus its amassed depreciation). Recall that the asset’s e-book worth declines each time that depreciation is credited to the associated contra asset account Accumulated Depreciation. In most depreciation methods, an asset’s estimated useful life is expressed in years. Nevertheless, within the units-of-activity methodology (and in the similar units-of-production method), an asset’s estimated useful life is expressed in models of output. In the units-of-activity technique, the accounting period’s depreciation expense isn’t a perform of the passage of time. Instead, each accounting period’s depreciation expense is based on the asset’s usage in the course of the accounting period.

Deja una respuesta